Flexible Spending Account (FSA)

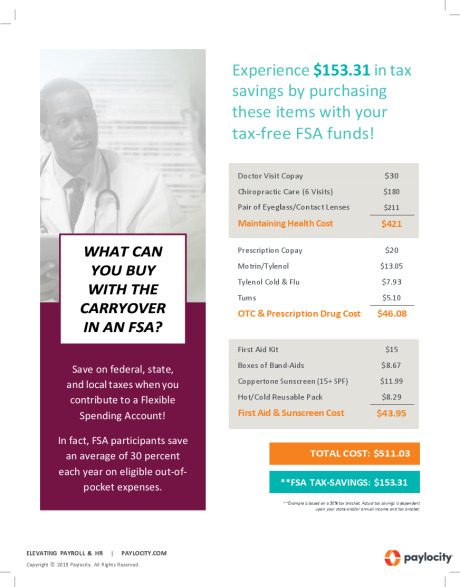

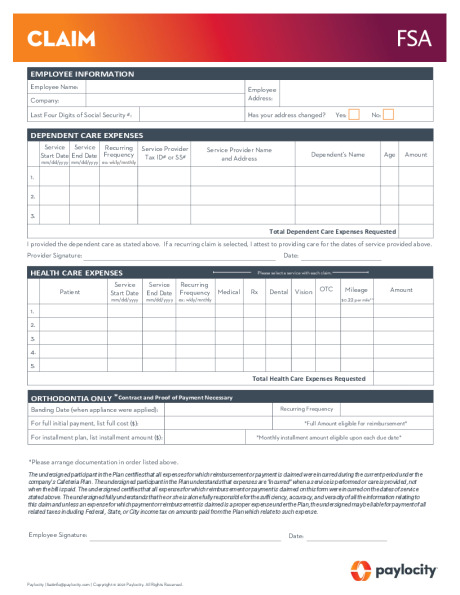

Denbright offers health care and dependent care flexible spending accounts (FSAs), administered by Paylocity, which allows you to pay for eligible health and dependent care expenses with pre-tax dollars. The money contributed to your account is deducted from your paychecks before tax is taken out, so you end up with lower taxable income for the year.

Health Care FSA

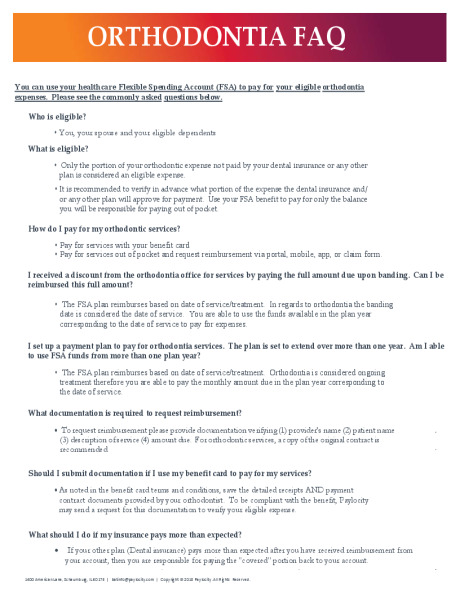

You can enroll in a Health Care FSA only if you are not enrolled in Denbright’s High Deductible Health Plan with a Health Savings Account (HSA). As long as you are not enrolled in the HSA, you can enroll and use the Health Care FSA to pay for eligible medical, dental, vision and other out-of-pocket health care expenses that aren’t covered by your health plan.

You can contribute up to $3,400 for 2026.

Estimate Carefully

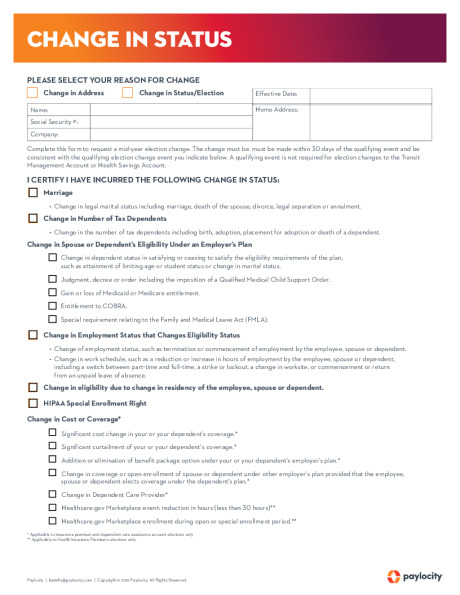

Once you have made your FSA election amounts, you cannot make changes during the plan year unless you experience a qualifying family status change.

You cannot use money from your Health Care FSA to pay for dependent care expenses, or vice versa. Keep in mind FSAs are “use-it-or-lose-it” accounts. You will forfeit any funds left in the account at the end of the plan year.

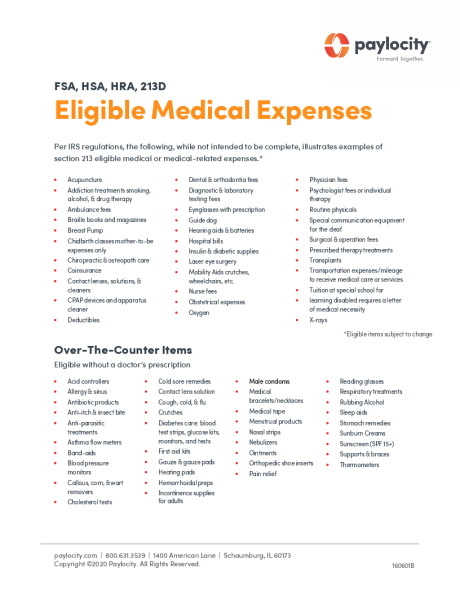

Eligible Expenses

A list of eligible health care expenses can be found in Publication 502 on the IRS website at https://www.irs.gov/pub/irs-pdf/p502.pdf

Eligible dependent care expense information can be found in Publication 503 at https://www.irs.gov/pub/irs-pdf/p503.pdf

Dependent Care FSA

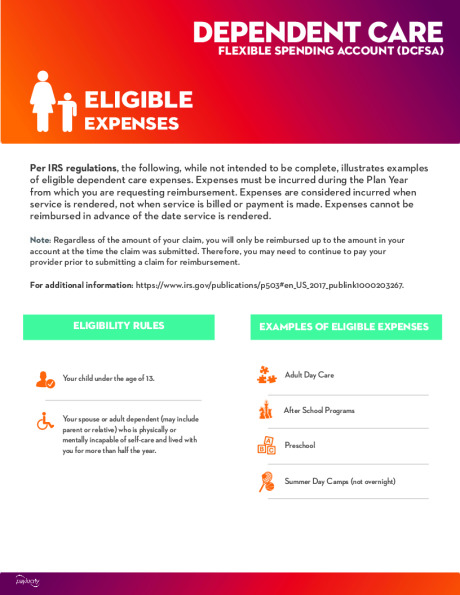

Dependent Care Flexible Spending Account (DCFSA)

This account can be used to pay for eligible child or adult day care. To be considered an eligible expense, the care must be necessary to enable both you and your spouse or domestic partner, if applicable, to work, look for work or attend school. Eligible dependents include: your children under age 13 or dependent of any age who resides in your home for at least eight hours each day who is physically or mentally incapable of self-care and is dependent on your for at least 50% of their financial support.

You will be able to contribute up to $7,500 for 2026

Commuter Benefits

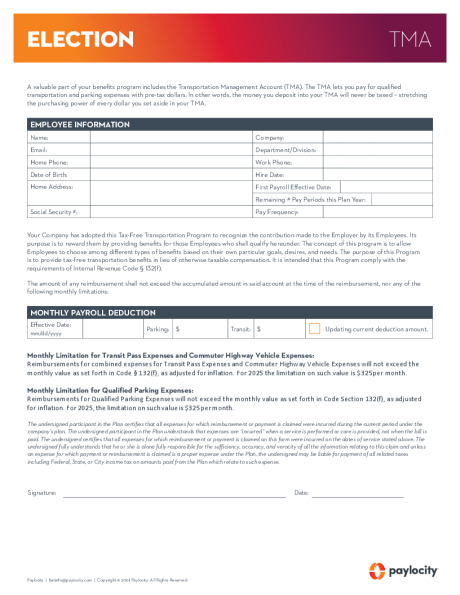

TRANSPORTATION MANAGEMENT ACCOUNT (TMA)

A TMA is an employer-sponsored benefit that enables employees to contribute pre-tax funds into an account to pay for work-related commuting costs. The account reimburses them for expenses like parking, buses, vanpooling, and subway or commuter train costs.

How the Program Works

You can elect to participate in this program at any time, not just during annual Open Enrollment, and set aside pretax money to cover your transportation and commuting costs.

■ Parking — Out-of-pocket parking fees for parking meters, garages, and lots. (Parking at or near your home is not eligible.) The IRS Pre-tax limit for 2026 is $340 per month.

■ Mass Transit/Van Pooling — Transit passes, tokens, fare cards, vouchers or similar items entitling you to ride a mass transit vehicle to or from work. The IRS Pre-tax limit for 2026 is $340 per month.

If you spend more than the monthly IRS limit, that additional amount must be paid by you on an after–tax basis and you would enter your payment method on-line. Any money left in your commuter benefit accounts will transfer into your accounts for the following year!