Which Medical Plan is Right?

California employees have medical plan choices from Cigna or Kaiser. Please scroll down or select a link to see details on Cigna and Kaiser plans.

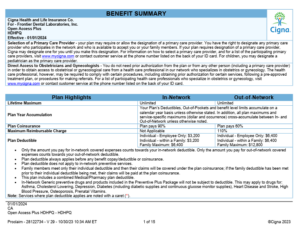

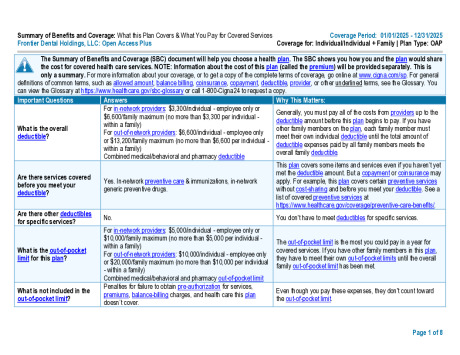

Cigna

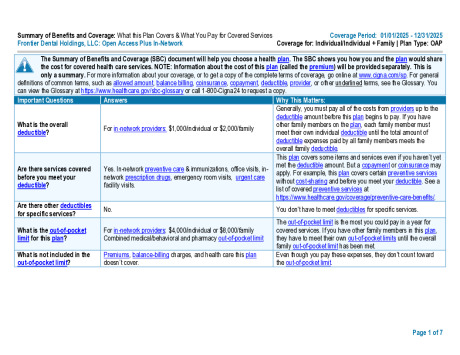

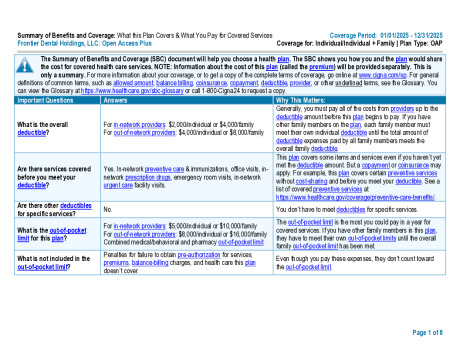

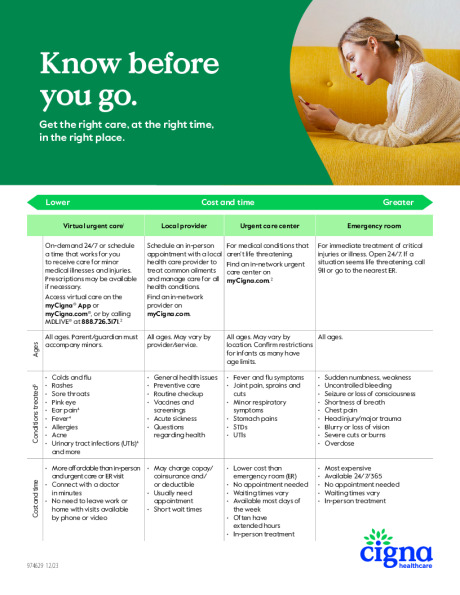

Medical coverage is provided through Cigna. The medical coverage includes a national network of physicians, specialists and hospitals. Denbright offers employees medical coverage through Cigna’s Open Access Plus (OAP) Network. Below is a snapshot of what is covered under the plan. To see a full, comprehensive list, please refer to the Summary of Benefits. Plan Costs are communicated separately.

Cigna Medical Plan Comparison

| Cigna | OAP In-Network Only | Open Access Plus | Open Access Plus HDHP | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Benefit | In-Network | Out-of-Network | In-Network | Out-of-Network | In-Network | Out-of-Network | |||

| Contract Year Deductible | $1,000 Individual $2,000 Family |

N/A | $2,000 Individual $4,000 Family |

$4,000 Individual $8,000 Family |

$3,300 Individual $6,600 Family |

$6,600 Individual $13,200 Family | |||

| After Deductible Plan Pays | 80% | N/A | 80% | 60% | 90% | 60% | |||

|

Contract Year Out-of-Pocket Maximum (includes Rx) |

$4,000 Individual $8,000 Family |

N/A | $5,000 Individual $10,000 Family |

$8,000 Individual $16,000 Family |

$5,000 Individual $10,000 Family |

$10,000 Individual $20,000 Family | |||

| Lifetime Maximum | Unlimited | N/A | Unlimited | Unlimited | Unlimited | Unlimited | |||

| Preventive Care for Adults & Children | 100% | N/A | 100% | 60%, after deductible | 100% | 60%, after deductible | |||

|

Doctors Office Visits Primary Care Specialist Urgent Care |

$25 Copay / $60 Copay / $50 Copay |

N/A |

$30 Copay / $70 Copay / $60 Copay |

60%, after deductible | 90%, after deductible | 60%, after deductible | |||

| Inpatient / Outpatient Facility Charges | 80%, after deductible | N/A | 80%, after deductible | 60%, after deductible | 90%, after deductible | 60%, after deductible | |||

| Emergency Room Facility Charges* | $400 Copay 80% after deductible |

N/A | $400 Copay 80% after deductible |

$400 Copay 80% after deductible |

90%, after deductible | 90%, after deductible | |||

| Ambulance | 80%, after deductible | N/A | 80%, after deductible | 80%, after deductible | 90%, after deductible | 90%, after deductible | |||

|

Chiropractic Benefits ($1,500 annual max) |

$25 Copay | N/A | $30 Copay | 60%, after deductible | 90%, after deductible | 60%, after deductible | |||

| Independent Labs | 80%, after deductible | N/A | 80%, after deductible | 60%, after deductible | 90%, after deductible | 60%, after deductible | |||

To view Cigna Plan Documents, CLICK HERE

We understand how confusing and overwhelming it can be to review your health plan options. And we want to help by providing the resources you need to make a decision with confidence. That’s why Cigna One Guide® service is available to you now.

Call a Cigna One Guide representative during preenrollment to get personalized, useful guidance.

Your personal guide will help you:

Easily understand the basics of health coverage

Identify the types of health plans available to you

Check if your doctors are in-network to help you avoid unnecessary costs

- Get answers to any other questions you may have about the plans or provider networks available to you

The best part is, during the enrollment period, your personal guide is just a call away.

Don’t wait until the last minute to enroll.

Call 888.806.5042 to speak with a Cigna One Guide representative today.

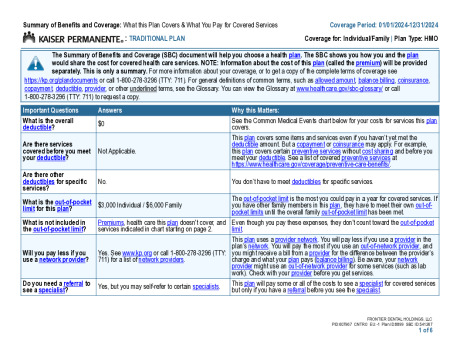

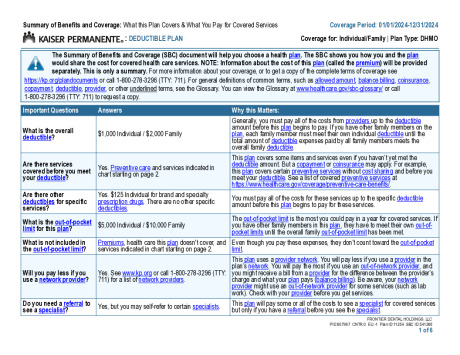

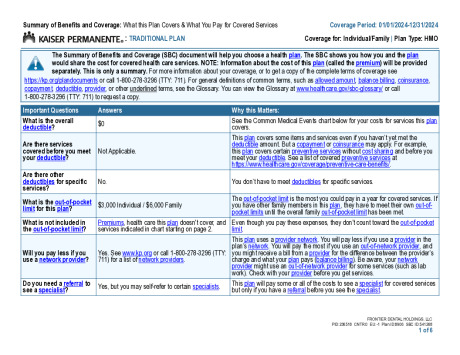

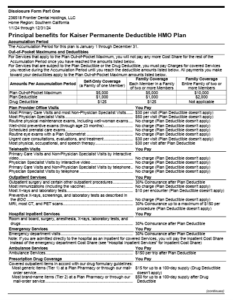

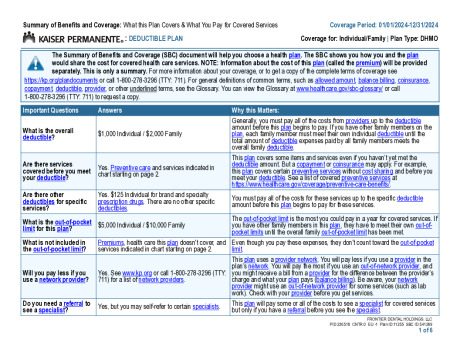

Kaiser

Medical coverage is provided through Kaiser Permanente. The medical coverage includes a regional network of physicians, specialists and hospitals. Denbright offers employees medical coverage through Kaiser’s Health Maintenance Organization (HMO) plan. Below is a snapshot of what is covered under the plan. To see a full, comprehensive list, please refer to the Summary of Benefits. Plan Costs are communicated separately.

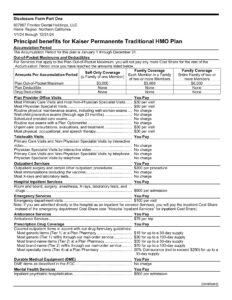

Prescription Drug - California Only

When you enroll in a medical plan, you automatically receive prescription drug benefits. Please see the chart below for an overview of the Kaiser prescription drug benefits.

Kaiser Medical Plan Comparison

California Only

| Kaiser | Health Maintenance Organization (HMO) | Deductible Health Maintenance Organization (DHMO) | ||||||

|---|---|---|---|---|---|---|---|---|

| Benefit | In-Network | Out-of-Network | In-Network | Out-of-Network | ||||

| Contract Year Deductible | $0 Individual $0 Family |

N/A | $1,000 Individual $2,000 Family |

N/A | ||||

| After Deductible Plan Pays | N/A | N/A | 70% | N/A | ||||

|

Contract Year Out-of-Pocket Maximum (includes Rx) |

$3,000 Individual $6,000 Family |

N/A | $5,000 Individual $10,000 Family |

N/A | ||||

| Lifetime Maximum | Unlimited | N/A | Unlimited | N/A | ||||

| Preventive Care for Adults & Children | 100% | N/A | 100% | N/A | ||||

|

Doctors Office Visits Primary Care Specialist Urgent Care |

$30 Copay $50 Copay $30 Copay |

N/A |

$30 Copay $50 Copay $30 Copay |

N/A | ||||

| Inpatient / Outpatient Facility Charges | $500 per Admission / $200 per Procedure | N/A | 30% Coinsurance after plan deductible |

N/A | ||||

| Emergency Room Facility Charges* | $100 per Visit | N/A | 30% Coinsurance after plan deductible |

N/A | ||||

| Ambulance | $75 per Trip | N/A | $150 per Trip after plan deductible |

N/A | ||||

| Chiropractic Benefits | $15 per Visit | N/A | $15 per Visit | N/A | ||||

| Independent Labs | N/A | N/A | N/A | N/A | ||||

| *Out of Network Emergency Facility and Professional charges are subject to In Network Coinsurance and/or Co pay and Out of Network Benefit Year Deductible and Out of Pocket. | ||||||||

Prescription Plan Comparison - California Only

| Benefit | HMO Plan | DHMO Plan |

|---|---|---|

| Prescription Deductible | N/A | $125 per Individual |

Retail Pharmacy (per 30-day supply)

|

$15 Copay $35 Copay 20% Coinsurance (not to exceed $250) |

$15 Copay, Drug deductible does not apply $50 Copay, After drug Deductible $50 Copay, After drug Deductible |

Retail and Home Delivery Pharmacy (per 100-day supply)

|

$30 Copay $70 Copay |

$15, Drug deductible does not apply $50 Copay, After drug Deductible |